PROJECT SUMMARY

Mission OYO I-10 West proposes to renovate the existing OYO Hotel at 6911 Pensacola Boulevard into an affordable housing solution.

The northwest panhandle region of Florida is facing, as is the rest of the country, a shortage of affordable housing for low-income and homeless men, women, and children. Area residents who are struggling to make ends meet include individuals who work in the hospitality, health, medical, and law enforcement industries, seniors, those with physical and behavioral health issues, individuals successfully exiting incarceration, veterans, youths aging out of the foster care system, and active-duty military personnel.

The 2022 Rental Market Study performed by the Shimberg Center for Housing Studies, indicated that Escambia and Santa Rosa counties had a combined deficit of 7,891 affordable housing units available for households at or below 50% of area median income.

For the Pensacola metropolitan statistical area (MSA), the 2023 annual point in time count (a count on one day only) included 438 sheltered and 742 unsheltered men, women and children, a total of 1,080 of our community members that are unable to afford housing.

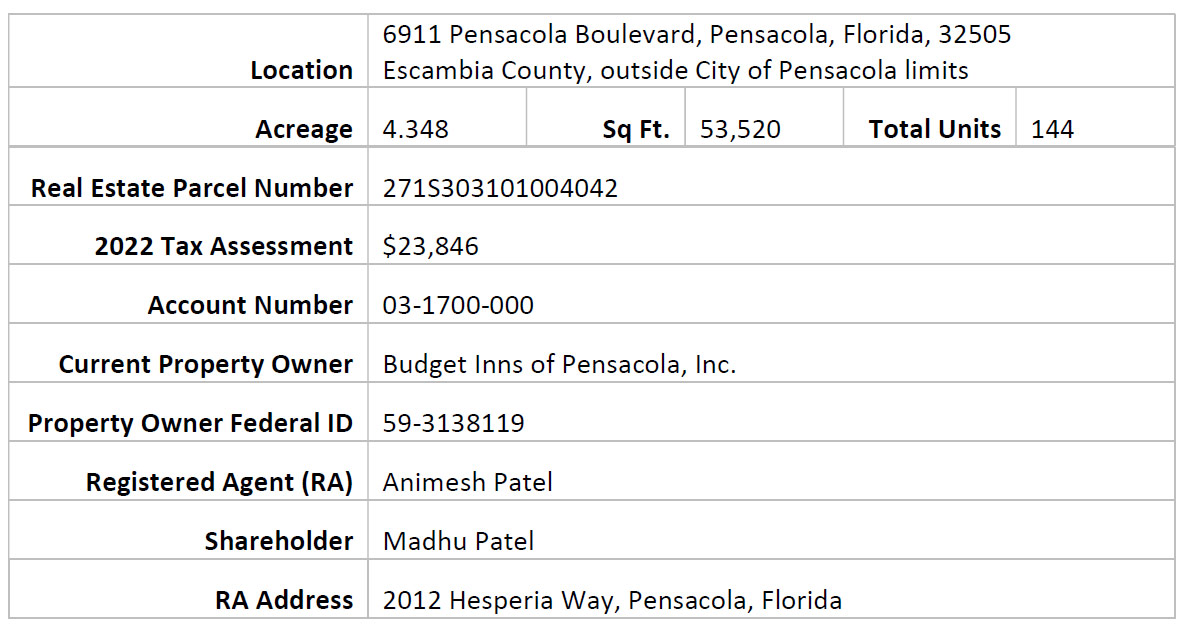

PROPERTY SNAPSHOT

PROPERTY DESCRIPTION

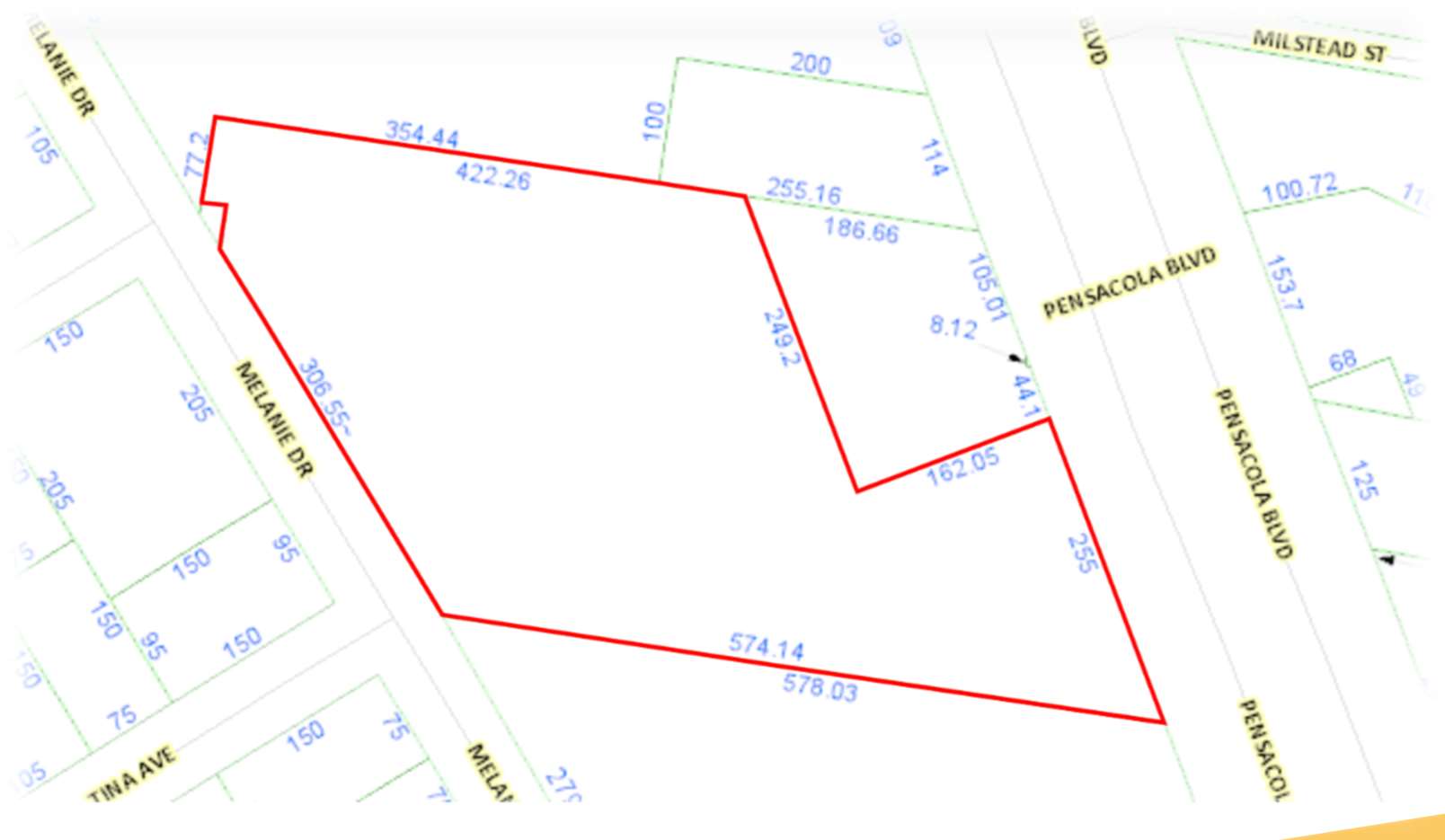

Located at the junction of Highway 29 and I-10, this affordable housing solution would be within walking distance to churches, schools, grocery stores, retail businesses, restaurants, and entertainment complexes.

Located at the junction of Highway 29 and I-10, this affordable housing solution would be within walking distance to churches, schools, grocery stores, retail businesses, restaurants, and entertainment complexes.

The Property is approximately 53,520 square feet with 144 units, 122 of which are residential rooms. Twenty-two (22) units have been vacant for an extended period due to hurricane damage.

Sales information indicates that 22 of the units are suites. A specific detailed site plan will need to be obtained.

The listing information indicates that the lot size is 4.348 acres, was built in 1973, is zoned C-2, and is comprised of one, 2 story building, although the property tax information shows three separate two story buildings. There is also an office area, the size of which has not been determined. We estimate that each residential room is approximately 350 square feet, although some suites may be larger. Some units may be ADA compliant, but the number is undeterminable at this time. Renovation and tenant-mix may alter the total number of units available.

PROJECT COSTS

| The total project budget is estimated as follows: | |

|---|---|

| Acquisition and related closing costs | $5,250,000 |

| Renovation and other costs | $4,235,800 |

| Developer fee at 10% of above costs | $1,000,000 |

| Total cost | $10,485,800 |

| Projected final cost per unit | $72,818 |

Further funding sources needed to complete the project are yet to be identified.

Funding sources could include the following:

- City of Pensacola

- Escambia County

- State of Florida

- Assumption of existing debt if any

- Creation of new debt

- Other sources

See Exhibit B – Sources and Uses of Funds for more details.

GOVERNANCE, MANAGEMENT, AND OWNERSHIP

The proposed owner of the Property will be 6911 Pensacola Blvd LLC (LLC to be established). Florida Housing Enterprises, Inc., (FHE) a 501(c)(3) not for profit Florida corporation will be the sole member and manager of the LLC. The FHE Board of Directors will be made up of individuals that are familiar with the needs of the region.

The lower the debt amount on the Project, the more reasonable the tenant rents will be. We expect that the tenant rent will include all utilities. Electricity, gas, trash removal, basic television cable and Wi-Fi internet will be provided by the owner; however, tenant is responsible for enhanced television cable and internet. Sources and uses projections (Exhibit B – Sources and Uses of Funds) and 15-year operating projections (Exhibit C – 15 Year Operating Pro Forma) are attached. The projections are estimates and will be modified after appropriate due diligence efforts (DDE) are performed. See Exhibit A – Tenant Rent Assumptions for details on rental levels.

DUE DILIGENCE EFFORTS (DDE)

DDE includes:

- an independent appraisal ($10,000)

- a phase one environmental report including testing for asbestos and lead based paint,($10,000),

- a property survey ($5,000)

- a property condition report ($10,000).

Direct DDE costs without administrative costs are approximately $35,000. Once a purchase/sale agreement is signed, the DDE will take up to 90 days to complete. After the results of the DDE are obtained, the purchase/sale agreement along with the financial projections will be updated accordingly.

ADDITIONAL CONSIDERATIONS

Other items for consideration on the Project include the following:

- After the above is determined, a project completion schedule will be developed.

- Since this is a hotel, we presume that a rezoning effort will likely be necessary through Escambia

County. This effort can commence only after a Purchase/Sale agreement is executed and the LLC

has official site control. The various costs, time, and resources needed to accomplish the

rezoning efforts are currently unknown. - Further investigation and conversation with Escambia County may be needed regarding

additional renovation costs that may be triggered by added code requirements due to the

zoning conversion from a hotel to housing. - This building was constructed in 1973. As such, environmental testing will be required to test for

asbestos and lead-based paints. - The monthly tenant rents shown were determined by the U.S. Department of Housing and

Urban Development (HUD). These rents will apply if any Federally sourced funds are used to

acquire and/or renovate the Project. The tenant rent amounts used were determined as of May

of 2023. HUD updates the rent amounts annually in April; however, an update has not yet been

published for 2023. When published, the tenant rent projections will be adjusted accordingly. - No decisions have been made regarding Project vendors including, but not limited to, an

architect, legal counsel, general contractor, project manager, appraiser, environmental

reviewers, surveyor, or property condition assessment contractor. - As all the above items are completed/determined, a timeline will be developed, specifically

working with the selected architect. - Based on the assumptions used in the attached projections, this project could support debt of

approximately $3,800,000, assuming a 30 year note at 7% interest. The other needed funding

has not been identified/determined. - This Project may be a candidate for Federal low-income housing tax credits (LIHTC). LIHTC

financing is an extremely competitive process. - The Project assumes some portion of the tenant mix will include populations that will require

supportive services to assure they maintain their tenancy. Supportive services costs are included

in the attached 15-year operating cost projections (Exhibit C – 15-Year Operating Pro Forma). - The Project provides for both operating reserves and replacement reserves. A separate schedule

with assumptions is attached (Exhibit D – Projected Operating and Replacement Reserves).

EXHIBITS

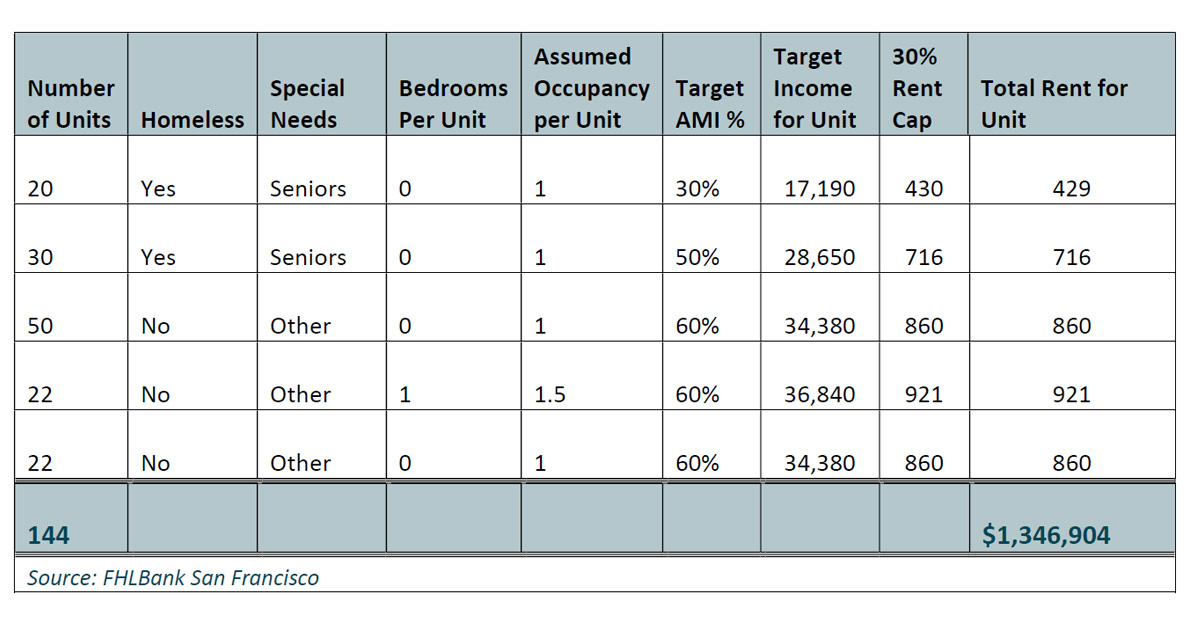

EXHIBIT A - TENANT RENT ASSUMPTIONS